Introduction: Comprehensive Guide to Manage Investment Risk

Investment risk is an inherent part of financial planning that no investor can ignore. Whether you’re venturing into the unpredictable stock market, diving into the safety net of bonds, or exploring alternative investments like cryptocurrency, risk remains a key consideration. Understanding and managing this risk effectively allows you not just to protect your financial capital but also to optimize your returns. In this guide, we provide an in-depth exploration of investment risk, elaborate on various types, and share expert advice to help you navigate these challenges like a seasoned investor.

Breaking Down Investment Risk: The Foundation of Financial Decision-Making

Investment risk refers to the uncertainty about the future value of an asset or portfolio, with the potential for loss always lurking in the background. Investors must be prepared to face risks resulting from external economic, political, and environmental factors.

Key Types of Investment Risk and Detailed Examples

- Market Risk:

Market risk, or systemic risk, stems from macroeconomic factors that affect the entire market. For instance, during the 2008 financial crisis, global markets saw a massive downturn due to a combination of factors including subprime mortgage failures and banking collapses.

Mitigation Strategy:

Diversify investments across multiple asset classes and industries. For example, balancing tech stocks with healthcare or energy sector equities can reduce exposure to any single market shock. - Credit Risk:

Credit risk primarily affects fixed-income investments like bonds and occurs when issuers fail to meet repayment obligations. In 2001, the bankruptcy of Enron Corporation caused bondholders significant losses, underscoring the importance of evaluating credit ratings.

Mitigation Strategy:

Opt for bonds with high credit ratings from agencies like Moody’s or Standard & Poor’s. A practical choice for cautious investors might include AAA-rated government bonds. - Liquidity Risk:

Liquidity risk arises when an investor struggles to sell an asset quickly without substantial loss. This often occurs with real estate or niche investments.

Example: During the COVID-19 pandemic, many property owners faced difficulty selling properties as buyers held off due to economic uncertainty.

Mitigation Strategy:

Maintain a portion of your portfolio in highly liquid assets like ETFs or short-term money market funds. - Inflation Risk:

Inflation risk erodes purchasing power over time, affecting the real returns of investments. From 1979 to 1981, inflation rates in the U.S. exceeded 10%, significantly impacting savings and bond investments.

Mitigation Strategy:

Consider investing in Treasury Inflation-Protected Securities (TIPS), which adjust principal amounts according to inflation levels. - Interest Rate Risk:

This risk affects bondholders when rising interest rates decrease bond values. For example, when the Federal Reserve raised interest rates in 2022 to combat inflation, long-term bond prices saw sharp declines.

Mitigation Strategy:

Incorporate short-duration bonds or floating-rate securities into your portfolio to minimize the impact of rate hikes.

How Risk Tolerance Shapes Your Investment Decisions

Every investor has a unique level of risk tolerance, dictated by personal circumstances, financial goals, and emotional resilience.

Factors Influencing Risk Tolerance and Its Importance

- Age and Investment Horizon:

Young investors often have higher risk tolerance due to their ability to recover from market downturns over a longer timeline. Conversely, those nearing retirement may prioritize capital preservation over high returns. - Wealth and Financial Goals:

A high net worth individual may allocate more funds to high-risk assets like equities, while someone saving for a home down payment might prefer low-risk investments like certificates of deposit. - Emotional Stability During Market Volatility:

The ability to withstand temporary losses without panicking is as crucial as financial capability. Behavioral finance studies have shown that investors often sell during market dips, crystallizing losses unnecessarily.

Implementing a Balanced Investment Approach

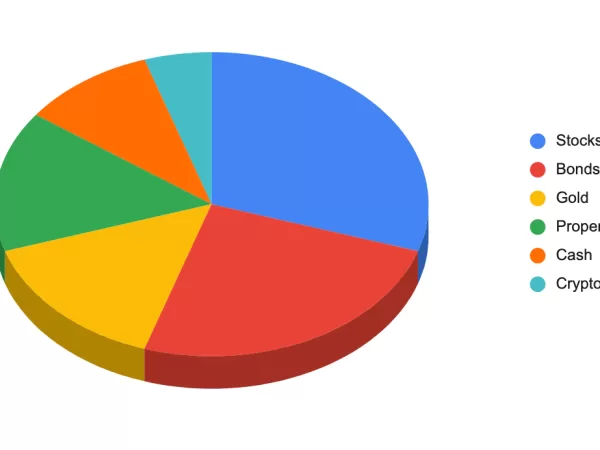

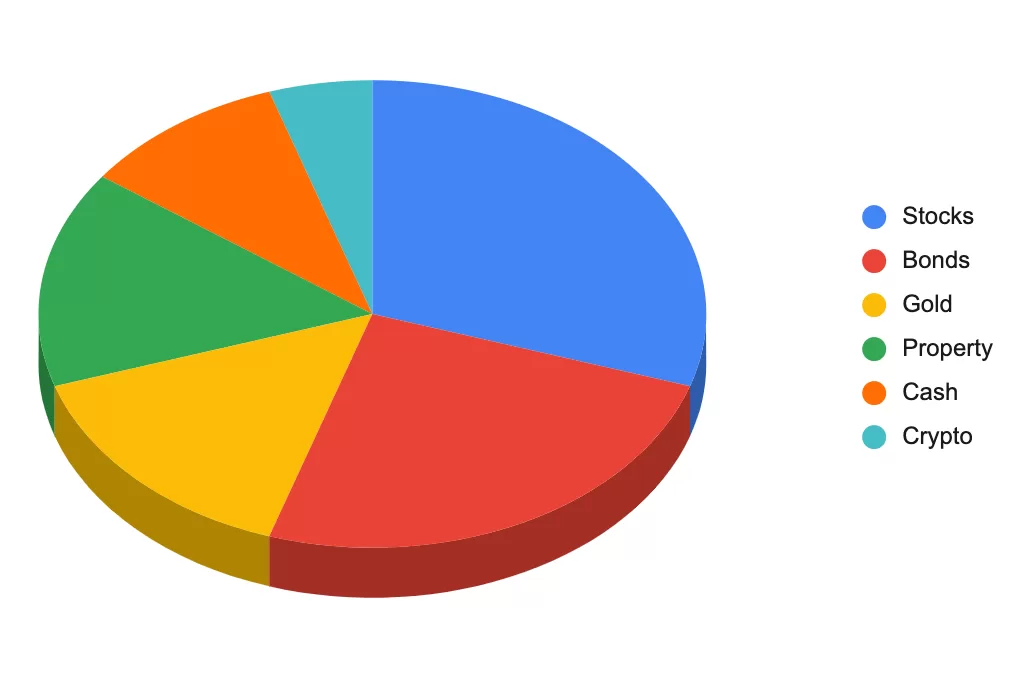

Balancing risk and reward involves diversifying across stocks, bonds, and other assets in proportions that reflect your risk tolerance. A common rule of thumb is the “100 minus age” strategy, which suggests that a 30-year-old could invest 70% in equities and 30% in bonds.

The Power of Diversification in Mitigating Risks

Diversification spreads investments across a range of asset types to minimize exposure to any single risk factor.

Advanced Strategies for Diversification

- Sector-Wide Allocation:

Avoid over-investing in high-growth sectors like technology. Consider including stable industries such as utilities or healthcare. - Geographic Diversification:

Global portfolios can shield against localized economic shocks. For example, investing in both U.S. and emerging markets balances risks from either region. - Alternative Assets:

Explore commodities like gold, which often act as safe havens during economic uncertainty. Adding hedge funds or REITs (Real Estate Investment Trusts) can further enhance diversification.

Behavioral Biases That Distort Risk Perception

Investors’ decisions are often clouded by cognitive biases, leading to suboptimal outcomes.

Identifying and Overcoming Behavioral Biases

- Herding Effect: Following market trends, as seen during the dot-com bubble of the late 1990s.

- Overconfidence Bias: A tendency to underestimate risks based on past successes.

- Recency Bias: Giving undue weight to recent events, like selling stocks after a short-term dip.

Actionable Tip:

Professional advice and robo-advisors can help investors maintain a rational approach.

Timeline of Risk Management in Investing

- 1930s: Harry Markowitz developed the Modern Portfolio Theory (MPT), revolutionizing diversification strategies.

- 1970s: Burton Malkiel introduced the idea of passive investing with his book A Random Walk Down Wall Street.

- 1987: Black Monday demonstrated the need for automated trading safeguards.

- 2010s: Big data and AI became central to risk analysis, improving predictive capabilities.

Experts Insights on Investment Risk

- Ray Dalio, founder of Bridgewater Associates, emphasizes that diversification is “the most powerful tool” for managing risk.

- Warren Buffett advises: “Risk comes from not knowing what you’re doing,” highlighting the importance of investor education.

Conclusion: Empowering Your Financial Journey

Investment risk is an integral aspect of wealth building. By understanding the nuances, recognizing biases, and leveraging diversification, you can transform risk into a strategic advantage. The wisdom of experts like Ray Dalio and Warren Buffett underscores the timeless value of knowledge and preparation in navigating financial uncertainty. Take these lessons to heart, and you’ll be well-equipped to achieve your investment goals.

📚 Take Your Trading And Financial Skills to the Next Level!

If you enjoyed this post, dive deeper with our Profitable Trader Series—a step-by-step guide to mastering the stock market.

- Stock Market 101: Profits with Candlesticks

- Stock Market 201: Profits with Chart Patterns

- Stock Market 301: Advanced Trade Sheets

Start your journey now!

👉 Explore the Series Here

For Regular Finance Updates Follow – Daily Business

FAQs

Q1. What is the best way to measure investment risk?

A: Investment risk can be measured using tools like beta (market volatility measure), standard deviation, and value-at-risk (VaR) calculations. Financial advisors often use these metrics to guide investment decisions.

Q2. How can beginners start investing with minimal risk?

A: Beginners can start with low-risk options such as index funds, ETFs, or savings bonds. It’s also essential to diversify and consult a financial advisor to align investments with long-term goals.

Q3. How does inflation affect investment risk?

A: Inflation decreases the purchasing power of money, impacting fixed-income securities like bonds. Investing in inflation-protected assets such as TIPS or commodities like gold can help mitigate this risk.

Q4. Are cryptocurrencies a high-risk investment?

A: Yes, cryptocurrencies are considered high-risk due to their volatility and lack of regulation. However, they can offer substantial returns as part of a well-balanced portfolio for risk-tolerant investors.

Q5. What are some examples of alternative investments for risk diversification?

A: Alternative investments include real estate, private equity, hedge funds, and commodities. These assets are less correlated with traditional markets, making them effective for risk diversification.