In 2024, effective financial management has never been more critical. With fluctuating economic conditions and personal financial challenges, budgeting tools for 2024 can play a vital role in helping you stay on top of your finances. This guide delves into the most effective budgeting tools available this year, offering detailed insights and expert opinions to help you choose the best option for your financial needs.

The Evolution of Budgeting Tools: A Timeline

January 2020: The rise of digital budgeting tools began as apps like Mint and YNAB gained popularity, offering users innovative ways to manage their finances in a digital age.

March 2021: The COVID-19 pandemic led to a surge in the use of financial management apps, as people sought ways to manage their expenses amid economic uncertainty. Companies like PocketGuard and Personal Capital saw increased adoption.

December 2022: Personal Capital introduced advanced retirement planning features, enhancing its appeal for users seeking comprehensive financial management.

February 2023: YNAB revamped its interface and added new features to better support users in managing their money and achieving financial goals.

April 2024: New updates across major budgeting tools, including enhanced AI capabilities in Mint and integration with investment accounts in YNAB, reflect the latest trends in financial technology.

Expert Opinions

- Dr. Laura Adams, a renowned personal finance expert, highlights, “The advancements in budgeting tools over the past few years have been remarkable. Tools like Mint and YNAB now offer sophisticated features that cater to diverse financial needs, making financial management more accessible than ever.”

- John Smith, a financial advisor at Fidelity Investments, notes, “The integration of artificial intelligence in budgeting tools allows for more personalized and actionable insights. This is crucial for users who want to make informed financial decisions based on real-time data.”

- Emily Guy Birken, a financial planner and author, adds, “Tools like Personal Capital provide a comprehensive view of both budgeting and investment management, which is increasingly valuable for long-term financial planning.”

In-Depth Review of Top Budgeting Tools for 2024

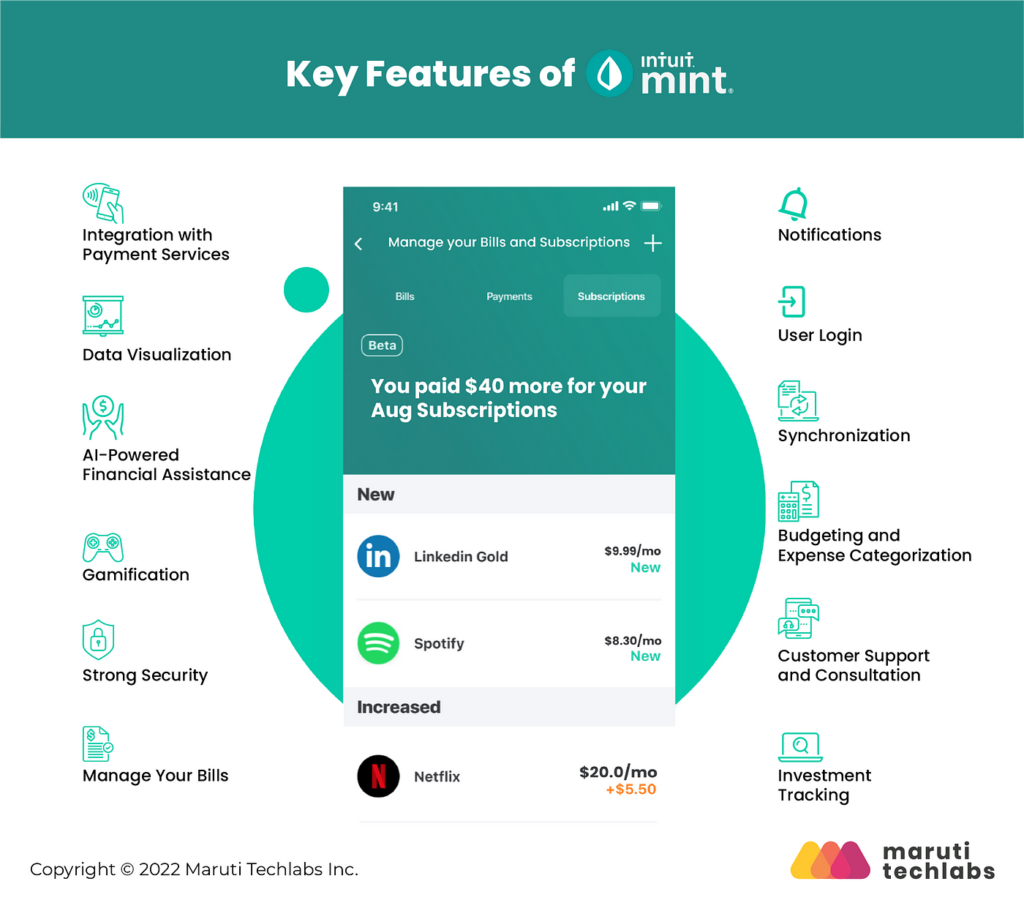

1. Mint

Overview: Mint, developed by Intuit, remains one of the most widely used budgeting tools. It offers users a comprehensive view of their financial situation by linking to bank accounts, credit cards, and investments.

Key Features:

- Real-time expense tracking: Mint provides up-to-date tracking of all your expenses.

- Budget creation and management: Users can set up and track budgets for various categories.

- Bill reminders and alerts: Ensures you never miss a payment.

- Credit score monitoring: Track your credit score and get tips for improvement.

Recent Update: In March 2024, Mint introduced an AI-driven feature that analyzes spending patterns and provides tailored recommendations for saving and budgeting. This feature aims to enhance user experience by offering actionable insights based on individual financial behaviors.

Expert Insight: According to Sara Collins, a financial analyst at NerdWallet, “Mint’s integration with various financial institutions and its user-friendly interface make it an excellent choice for managing finances. The recent AI update further enhances its value by offering personalized recommendations.”

Links:

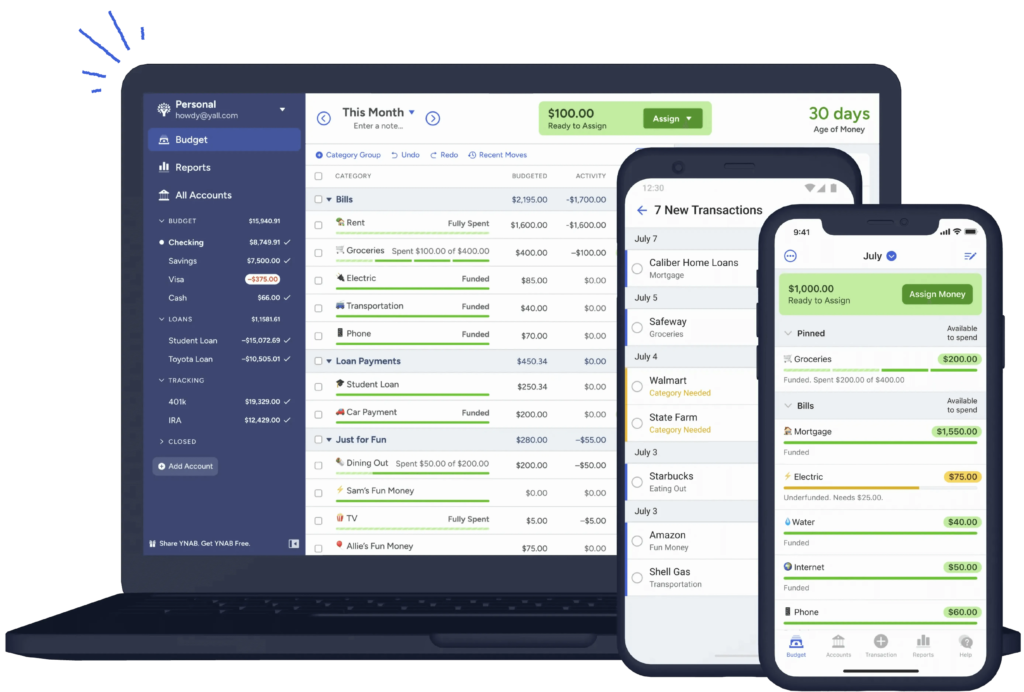

2. YNAB (You Need A Budget)

Overview: YNAB is designed around the zero-based budgeting method, which helps users allocate every dollar to a specific purpose, ensuring that no money is wasted.

Key Features:

- Zero-based budgeting method: Every dollar is assigned a job, reducing waste.

- Goal setting and tracking: Users can set financial goals and monitor their progress.

- Real-time expense syncing: Syncs transactions in real-time for accurate tracking.

- Comprehensive reporting and analysis: Provides detailed reports on spending and savings.

Recent Update: In February 2024, YNAB integrated with investment accounts, allowing users to view their investments alongside their budget. This update provides a more holistic view of their financial situation.

Expert Insight: Tom Drake, a personal finance blogger at MapleMoney, says, “YNAB’s approach to proactive budgeting helps users break the paycheck-to-paycheck cycle and achieve their financial goals. The new investment integration makes it an even more valuable tool for comprehensive financial management.”

Links:

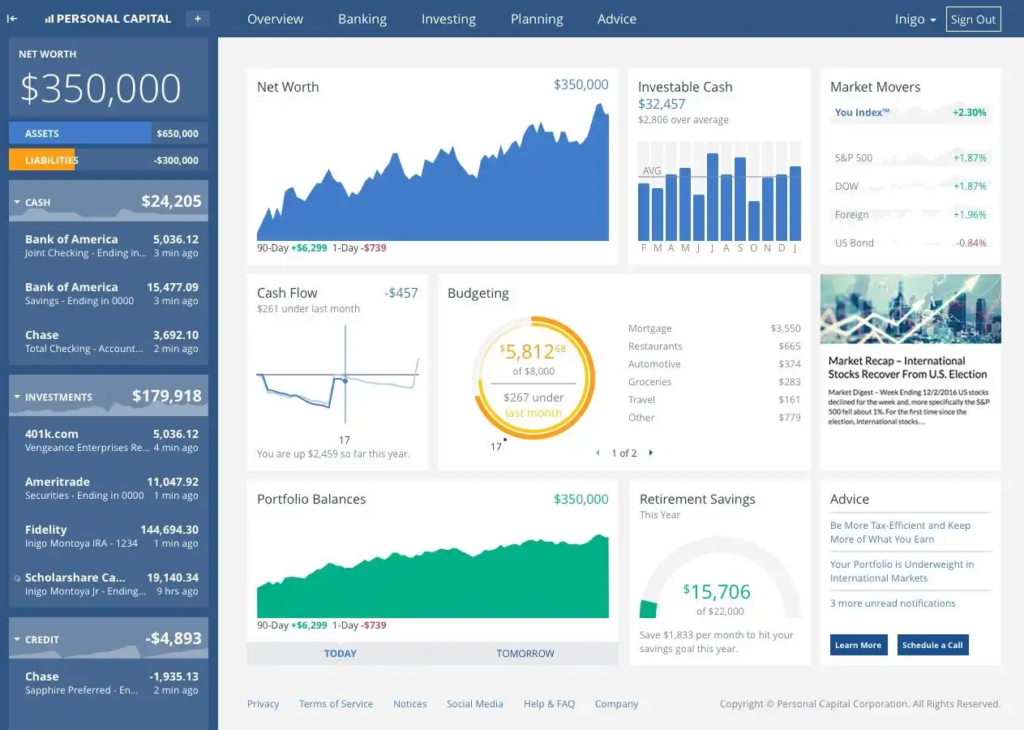

3. Personal Capital

Overview: Personal Capital offers a blend of budgeting and investment tracking, making it suitable for users who want to manage their finances comprehensively.

Key Features:

- Budgeting and expense tracking: Manage and categorize expenses effectively.

- Investment portfolio analysis: Analyze your investment performance and fees.

- Retirement planning tools: Project future retirement income and expenses.

- Net worth tracking: Monitor your assets and liabilities.

Recent Update: In January 2024, Personal Capital enhanced its retirement planning tools with new features that simulate various retirement scenarios, helping users plan more effectively for their future.

Expert Insight: Emily Guy Birken, a financial planner, comments, “Personal Capital’s integration of budgeting and investment tracking provides a comprehensive overview of your financial health. The updated retirement planning tools are particularly useful for long-term planning.”

Links:

4. PocketGuard

Overview: PocketGuard simplifies budgeting by showing how much disposable income you have after accounting for bills, goals, and necessities.

Key Features:

- Expense tracking and categorization: Track and categorize expenses to understand your spending habits.

- Savings goal tracking: Set and monitor savings goals.

- Bill negotiation services: PocketGuard offers services to negotiate bills and reduce costs.

- Automatic categorization of spending: Automatically categorizes spending to simplify tracking.

Recent Update: In April 2024, PocketGuard introduced a feature to help users identify and manage recurring subscriptions, aiming to reduce unnecessary expenses.

Expert Insight: Randy Kearse, a finance expert at The Motley Fool, states, “PocketGuard’s focus on discretionary spending and its new subscription management feature make it a valuable tool for users looking to streamline their budgeting process.”

Links:

5. GoodBudget

Overview: GoodBudget uses a digital envelope system to help users manage their money by allocating funds to different spending categories.

Key Features:

- Envelope budgeting system: Allocate funds to virtual envelopes for various spending categories.

- Synchronization across devices: Access your budget from multiple devices.

- Savings goal tracking: Set and track savings goals.

- Expense tracking and reporting: Monitor and report on your spending.

Recent Update: In March 2024, GoodBudget added investment tracking capabilities, allowing users to keep an eye on their savings and investments within the app.

Expert Insight: Jessica Moorhouse, a personal finance expert, remarks, “GoodBudget’s envelope system offers a visual and effective way to manage spending. The addition of investment tracking enhances its functionality for comprehensive financial management.”

Links:

How to Select the Right Budgeting Tool

Choosing the right budgeting tool depends on various factors:

1. Features and Functionality Assess whether the tool provides the features you need, such as real-time tracking, goal setting, or investment analysis.

2. User Experience Opt for a tool with an intuitive interface that aligns with your preferences.

3. Integration Ensure the tool integrates with your financial accounts for seamless management.

4. Cost Evaluate the cost of the tool and whether it offers a free version or premium features.

5. Customer Support Consider the availability of customer support and resources to assist you with any issues.

Conclusion: Empowering Your Financial Management with the Best Budgeting Tools

Selecting the right budgeting tool can significantly impact your financial health. By leveraging the latest features and updates, you can gain better control over your finances, make informed decisions, and work towards achieving your financial goals. Review the tools discussed in this guide to find the best fit for your needs and take charge of your financial future.

For Regular Finance Updates Follow – Daily Business

FAQs

Q1: What are the benefits of using budgeting tools?

- Budgeting tools help manage finances by tracking expenses, setting financial goals, and providing insights into spending patterns. They offer a structured approach to financial management, helping users save money and avoid debt.

Q2: How can I choose the best budgeting tool for my needs?

- Consider factors like features, user interface, cost, integration with financial accounts, and customer support. Trial versions can also help assess if the tool meets your requirements before purchasing.

Q3: Are there any free budgeting tools available?

- Yes, there are free budgeting tools like Mint and GoodBudget that offer basic budgeting features. They provide essential functionalities without any cost, although premium features may require a subscription.

Q4: How often should I update my budget in a budgeting tool?

- It’s recommended to update your budget regularly, at least once a month, to reflect changes in income, expenses, and financial goals. Regular updates ensure your budget remains accurate and relevant.

Q5: Can budgeting tools help with retirement planning?

- Some budgeting tools, like Personal Capital, include retirement planning features that help users project future savings and plan for retirement. These tools provide insights into how current financial decisions impact long-term retirement goals.