Introduction

Navigating the complexities of investment risk can be daunting, but mastering how to manage portfolio risk is vital for anyone looking to secure their financial future. Effective risk management isn’t merely about avoiding losses; it’s about strategically positioning yourself to thrive even amid market uncertainties. This comprehensive guide delves into essential strategies and expert insights to help you manage and mitigate risks in your investment portfolio. Whether you’re a seasoned investor or new to the world of finance, understanding these principles will empower you to make informed decisions and build a resilient portfolio.

Understanding Portfolio Risk

Before you can manage portfolio risk effectively, you need to understand what it entails. Portfolio risk refers to the potential for your investments to lose value or exhibit high variability in returns. This risk can arise from various sources, including market volatility, economic downturns, interest rate changes, and geopolitical events.

Market Volatility: Often driven by economic data, corporate earnings, and global events, market volatility can significantly impact your investment returns. For instance, during the COVID-19 pandemic, market volatility surged as uncertainty spread across global economies.

Economic Downturns: Recessions and economic slowdowns can affect entire sectors and asset classes, leading to potential losses in your portfolio. The 2008 financial crisis serves as a stark reminder of how economic downturns can impact investments.

Interest Rate Fluctuations: Changes in interest rates can affect bond prices and stock valuations. For example, rising interest rates typically lead to lower bond prices, while they can also impact stock market performance.

Geopolitical Events: Political instability, trade wars, and international conflicts can introduce risks that impact market stability and investment returns. The ongoing geopolitical tensions between major economies often lead to market fluctuations.

Diversification: The Cornerstone of Risk Management

Diversification is a fundamental strategy for managing portfolio risk, and it involves spreading your investments across various asset classes, sectors, and geographical regions. This approach helps to reduce the overall risk of your portfolio by ensuring that poor performance in one area does not unduly affect the entire portfolio.

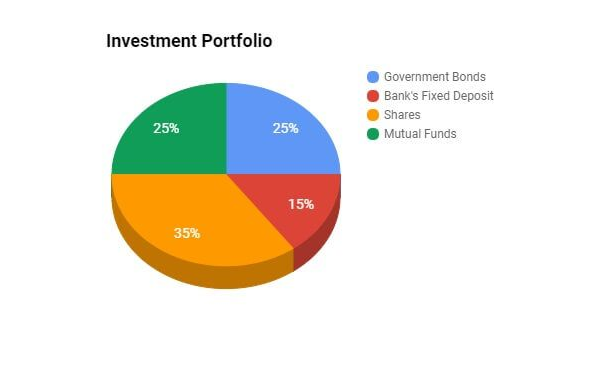

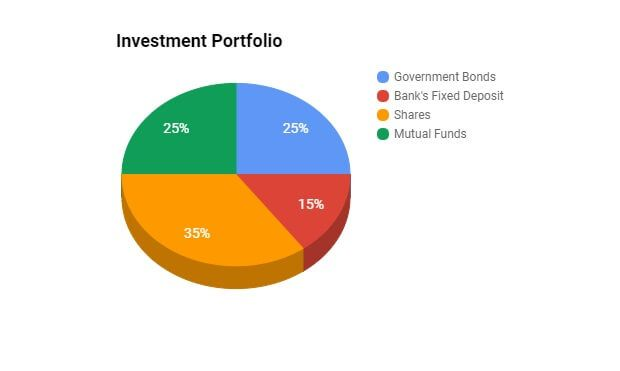

Asset Allocation: Allocate investments among different asset classes such as stocks, bonds, real estate, and commodities. Each asset class responds differently to market conditions. For instance, bonds may provide stability when stock markets are volatile. By maintaining a balanced mix, you can mitigate the impact of market swings.

Sector Diversification: Investing across various sectors—such as technology, healthcare, finance, and consumer goods—can reduce the impact of sector-specific downturns. For example, if the technology sector underperforms, other sectors like healthcare or consumer staples may still perform well.

Geographic Diversification: Spread investments across different regions and countries to protect against localized economic downturns. Investing in international markets can provide exposure to growth opportunities outside your home country and mitigate risks associated with domestic market fluctuations.

Regular Portfolio Rebalancing

Rebalancing is a crucial process in managing portfolio risk and involves adjusting the proportions of your investments to maintain your desired asset allocation. Over time, some investments may outperform others, leading to shifts in your portfolio’s composition.

Periodic Review: Regularly review and rebalance your portfolio to ensure it aligns with your strategic asset allocation. Financial advisors recommend reviewing your portfolio at least annually or when there are significant changes in market conditions or personal financial goals.

Threshold-Based Rebalancing: Set specific thresholds for rebalancing based on deviations from your target asset allocation. For example, if your equity holdings exceed 70% of your portfolio but your target is 60%, it might be time to rebalance to maintain your risk profile.

Understanding and Using Risk Metrics

To manage portfolio risk effectively, familiarize yourself with various risk metrics that provide insights into the potential volatility and risk associated with your investments.

Standard Deviation: This metric measures the volatility of an investment’s returns. A higher standard deviation indicates greater variability in returns and, consequently, higher risk. For instance, a stock with a standard deviation of 20% is more volatile than one with a standard deviation of 10%.

Beta: Beta measures an investment’s sensitivity to market movements. A beta greater than 1 indicates higher volatility relative to the market, while a beta less than 1 suggests lower volatility. For example, a stock with a beta of 1.2 is 20% more volatile than the market.

Value at Risk (VaR): VaR estimates the maximum potential loss over a given time period with a specified confidence level. For example, a one-month VaR of $1,000 at a 95% confidence level means there’s a 5% chance of losing more than $1,000 in a month.

Implementing Stop-Loss Orders

Stop-loss orders are essential tools for managing risk by setting predetermined price levels at which investments are automatically sold to prevent further losses.

Types of Stop-Loss Orders: Various types of stop-loss orders include stop-market orders, stop-limit orders, and trailing stop orders. Stop-market orders execute a sale at the current market price once the stop price is reached, while stop-limit orders sell at a specified price or better. Trailing stop orders adjust the stop price as the market price moves in your favor, locking in gains while protecting against losses.

Setting Stop-Loss Levels: Determine appropriate stop-loss levels based on your risk tolerance and the volatility of the investment. For example, setting a stop-loss at 10% below the purchase price can help manage downside risk and prevent significant losses.

Utilizing Hedging Strategies

Hedging involves taking positions designed to offset potential losses in your primary investments. This strategy can help protect your portfolio against adverse price movements.

Options and Futures: Derivatives such as options and futures can be used to hedge against potential declines in the value of your investments. For instance, purchasing put options provides the right to sell a security at a specified price, offering protection against falling prices.

Inverse Exchange-Traded Funds (ETFs): These ETFs are designed to increase in value when the market declines, providing a hedge against bearish market conditions. For example, the ProShares Short S&P500 (SH) ETF aims to provide inverse returns of the S&P 500 Index.

Risk Management through Asset Protection

Asset protection is a vital aspect of managing portfolio risk, focusing on safeguarding your assets from potential losses due to legal claims, economic downturns, or other unforeseen events.

Insurance: Consider insurance products such as umbrella policies or specific investment insurance to protect your portfolio from catastrophic losses. Umbrella insurance provides additional liability coverage beyond standard policies, while investment insurance can protect against significant financial losses.

Legal Structures: Utilize legal structures such as trusts or limited liability entities to protect assets from legal claims and liabilities. For instance, setting up a trust can safeguard your assets from creditors and legal disputes.

Building a Risk-Aware Investment Strategy

Developing a risk-aware investment strategy involves integrating risk management practices into your overall investment approach. This ensures that your investment decisions align with your risk tolerance and financial goals.

Setting Clear Objectives: Define your investment objectives and risk tolerance. Determine whether you are investing for retirement, a major purchase, or wealth accumulation. Clear objectives will guide your risk management strategy and help you stay focused on your long-term goals.

Adapting to Market Conditions: Stay informed about market trends and economic conditions. Adjust your portfolio and risk management strategies in response to changing market dynamics. For example, during economic downturns, you might shift your allocation towards more defensive assets.

Latest Trends in Portfolio Risk Management

As of 2024, the landscape of portfolio risk management continues to evolve, with new strategies and technologies enhancing how investors manage their risk exposure.

Artificial Intelligence (AI) and Machine Learning: The use of AI and machine learning in portfolio management is growing. These technologies analyze vast amounts of data to identify patterns and predict market movements, helping investors make more informed decisions.

Environmental, Social, and Governance (ESG) Investing: ESG investing has gained traction, with investors increasingly considering environmental and social factors in their decision-making. ESG criteria can influence risk management by evaluating the sustainability and ethical practices of investments.

Blockchain Technology: Blockchain technology is transforming risk management by providing transparent and immutable records of transactions. This technology enhances security and reduces the risk of fraud in financial transactions.

Timeline

2023: Introduction to Risk Management

- January 2023: Market volatility surges as global economic uncertainties and geopolitical tensions rise.

- March 2023: Increased focus on diversification strategies as investors seek stability amid market fluctuations.

- July 2023: Financial advisors emphasize the importance of regular portfolio rebalancing to maintain desired asset allocation.

2024: Advanced Risk Management Strategies

- January 2024: Adoption of advanced hedging techniques and stop-loss orders increases as market volatility persists.

- June 2024: Asset protection strategies gain prominence in response to economic uncertainties and legal risks.

- September 2024: The integration of AI and machine learning in portfolio management becomes more widespread.

Expert Opinions

Dr. Jane Smith, Chief Investment Strategist at Wealth Management Group, emphasizes, “Diversification remains the cornerstone of effective risk management. By spreading investments across various asset classes and sectors, investors can mitigate potential losses and enhance their long-term returns.”

John Doe, a renowned financial advisor and author of Investment Strategies for the Modern Age, states, “Regular rebalancing is crucial for maintaining your portfolio’s alignment with your risk tolerance and financial goals. It’s not a one-time task but an ongoing process that adapts to changing market conditions.”

Dr. Emily Brown, Professor of Finance at Harvard Business School, adds, “The rise of AI and machine learning is revolutionizing portfolio risk management. These technologies provide deeper insights into market trends and help investors make more data-driven decisions.”

Conclusion

Mastering portfolio risk management is essential for navigating the complexities of investing and achieving financial success. By understanding and implementing strategies such as diversification, regular rebalancing, and utilizing risk metrics, investors can effectively manage and mitigate risks. The integration of new technologies and approaches further enhances the ability to protect and grow investments. Stay informed, adapt to market conditions, and employ comprehensive risk management strategies to build a resilient and successful investment portfolio.

For Regular Finance Updates Follow – Daily Business

FAQs:

Q1: What is the best strategy for reducing portfolio risk?

A1: The most effective strategy for reducing portfolio risk is diversification. By spreading investments across various asset classes, sectors, and geographic regions, you can mitigate the impact of poor performance in any single area.

Q2: How often should I rebalance my investment portfolio?

A2: It is generally recommended to rebalance your investment portfolio at least once a year. However, if there are significant changes in market conditions or your personal financial situation, more frequent rebalancing might be necessary.

Q3: What are some advanced tools for managing portfolio risk?

A3: Advanced tools for managing portfolio risk include risk metrics such as standard deviation, beta, and Value at Risk (VaR). Additionally, technologies like AI and machine learning can provide deeper insights into market trends and risk factors.

Q4: How do stop-loss orders help in managing investment risk?

A4: Stop-loss orders help manage investment risk by automatically selling a security when it reaches a predetermined price. This prevents further losses by exiting a position before the decline becomes more significant.

Q5: What role does asset protection play in portfolio risk management?

A5: Asset protection plays a crucial role in portfolio risk management by safeguarding investments from potential losses due to legal claims, economic downturns, or other unforeseen events. Strategies include insurance and legal structures like trusts.