Investing doesn’t have to be complicated or intimidating. Adopting easy investment strategies for beginners can lay a solid foundation for future financial success. This comprehensive guide explores straightforward methods to start investing, provides expert insights, and offers up-to-date information on the best strategies to get you started.

Timeline of Key Developments and Expert Insights

January 2024: Nina Zolotow, a renowned financial author and speaker, emphasized the importance of simplicity in investing. In her latest book, Smart Money Moves, she stated, “As the investment landscape evolves, new tools and strategies have emerged that simplify the process for beginners. By starting with basic strategies, individuals can build a solid investment foundation without feeling overwhelmed.”

February 2024: Richard Davies, a leading financial analyst at The Financial Times, highlighted the growth of user-friendly investment platforms. In an article published on February 15, 2024, Davies remarked, “Investment platforms are increasingly designed to be intuitive and accessible, making it easier than ever for beginners to start investing. This shift is democratizing investing and making it more approachable for the average person.”

March 2024: According to a survey by Investopedia published on March 10, 2024, 65% of new investors are opting for robo-advisors. Jill Schlesinger, a certified financial planner, commented, “Robo-advisors are transforming investment management for beginners. They offer automated, low-cost solutions that handle portfolio management with minimal input from the investor.”

April 2024: Christine Benz, director of personal finance at Morningstar, released a report on April 5, 2024, emphasizing the benefits of diversification. “Diversification is crucial for risk management and achieving stable returns. Beginners should focus on creating a diversified portfolio to enhance their investment success and reduce risk.”

June 2024: Charles Schwab, founder of Schwab Investments, launched an updated educational initiative on June 1, 2024, aimed at new investors. Schwab’s initiative highlights the importance of understanding basic investment principles and offers a range of beginner-friendly investment options, including ETFs and index funds. “Educating yourself about the fundamentals of investing is essential for long-term success. Our new resources are designed to simplify these concepts and help beginners make informed decisions,” Schwab said.

Understanding Easy Investment Strategies for beginners

Investing is an essential aspect of financial planning, and starting with easy strategies can make the process smoother for beginners. Here’s an in-depth look at some of the most effective and straightforward investment strategies:

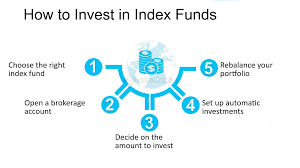

1. Invest in Index Funds and ETFs

Index Funds and Exchange-Traded Funds (ETFs) are ideal for those new to investing. They offer diversification and lower risk through broad market exposure.

- Index Funds: These funds track the performance of a specific market index, such as the S&P 500. They are known for their low fees and broad diversification. Consider the Vanguard Total Stock Market Index Fund (VTSAX) and the Schwab U.S. Broad Market ETF (SCHB). Vanguard Total Stock Market Index Fund Schwab U.S. Broad Market ETF

- ETFs: These funds trade on stock exchanges and provide diversification with flexibility. Popular ETFs include the SPDR S&P 500 ETF Trust (SPY) and the iShares Core U.S. Aggregate Bond ETF (AGG). SPDR S&P 500 ETF Trust iShares Core U.S. Aggregate Bond ETF

2. Utilize Robo-Advisors

Robo-Advisors are automated platforms that offer investment management services based on your goals and risk tolerance.

- Betterment and Wealthfront are popular robo-advisors that provide low-cost, automated investment solutions. They use algorithms to create and manage diversified portfolios for you. Betterment Wealthfront

3. Open a High-Interest Savings Account

A High-Interest Savings Account (HISA) offers a low-risk way to grow your savings with competitive interest rates.

- Ally Bank and Marcus by Goldman Sachs provide attractive interest rates and easy access to funds. These accounts are perfect for building an emergency fund or saving for short-term goals. Ally Bank Online Savings Account Marcus by Goldman Sachs

4. Invest in Retirement Accounts

Retirement Accounts offer tax advantages and are crucial for long-term financial planning.

- 401(k): Provided by many employers, these accounts allow for pre-tax contributions and often include matching contributions. The contribution limit for 2024 is $23,000, with an additional $7,500 for those aged 50 and over. IRS Retirement Plan Limits

- IRA: Individual Retirement Accounts come in traditional and Roth varieties. Traditional IRAs provide tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. For 2024, the contribution limit is $6,500, with an additional $1,000 for those aged 50 and over. Roth IRA Contribution Limits

5. Consider Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility and lowers the average cost of investments.

For instance, investing $100 each month into a fund means purchasing more shares when prices are low and fewer shares when prices are high. This strategy mitigates the risk of making a large investment at an inopportune time.

6. Explore Mutual Funds

Mutual Funds pool money from multiple investors to invest in a diversified portfolio managed by professionals.

- Actively Managed Funds: Managed by professionals aiming to outperform the market, these funds come with higher fees but potentially higher returns. Examples include the Fidelity Contrafund (FCNTX) and the T. Rowe Price Blue Chip Growth Fund (TRBCX). Fidelity Contrafund T. Rowe Price Blue Chip Growth Fund

- Passively Managed Funds: These funds aim to replicate the performance of an index. They typically have lower fees and are suitable for beginners. Examples include the Vanguard 500 Index Fund (VFIAX) and the Fidelity 500 Index Fund (FXAIX). Vanguard 500 Index Fund Fidelity 500 Index Fund

7. Educate Yourself Continuously

Continuous education is essential for making informed investment decisions. Resources include:

- Books: The Intelligent Investor by Benjamin Graham and Rich Dad Poor Dad by Robert Kiyosaki offer foundational investment knowledge.

- Online Courses: Websites like Coursera and Khan Academy provide free courses on investing basics.

- Financial News: Stay updated with reputable sources like The Wall Street Journal and Bloomberg for current market trends and insights.

8. Explore ESG Funds

Environmental, Social, and Governance (ESG) Funds cater to investors interested in ethical investing. These funds focus on companies meeting specific sustainability and social responsibility criteria. Notable ESG funds include the iShares ESG Aware MSCI USA ETF and the Vanguard FTSE Social Index Fund. iShares ESG Aware MSCI USA ETF Vanguard FTSE Social Index Fund

9. Keep an Eye on Fees and Expenses

Understanding investment fees and expenses is crucial for maximizing returns. Look for low-cost options, such as index funds and ETFs, which typically have lower expense ratios compared to actively managed funds. Use platforms like Morningstar and NerdWallet to compare fees and select the best investment options. Morningstar Fund Comparisons NerdWallet Investment Comparisons

Expert Opinions on Investment Strategies

Nina Zolotow recommends starting with simple investment options and gradually expanding as you gain experience. “Simplicity is key for beginners. Start with index funds and ETFs to build a diversified portfolio and avoid complex investments until you’re more comfortable.”

Richard Davies suggests utilizing technology for easy management. “Robo-advisors and modern investment platforms are game-changers. They offer automated solutions that are ideal for beginners who may not have the time or expertise to manage their investments actively.”

Jill Schlesinger advocates for low-cost investment solutions. “Robo-advisors provide an excellent entry point for new investors due to their cost-effectiveness and ease of use. They allow individuals to invest with minimal fees and complexity.”

Christine Benz emphasizes the importance of diversification. “Diversification helps mitigate risk and stabilize returns. Beginners should focus on creating a well-rounded portfolio to protect their investments from market fluctuations.”

Charles Schwab highlights the value of financial education. “Understanding the basics of investing is crucial. Our educational resources aim to empower new investors with the knowledge needed to make informed decisions and build a strong financial future.”

For Regular Finance Updates Follow – Daily Business

FAQs

Q1: What are some beginner-friendly investment platforms?

A1: For beginners, platforms like Robinhood and Acorns are user-friendly. Robinhood offers commission-free trades, while Acorns helps with automatic investing by rounding up purchases. Robinhood Acorns

Q2: How can I diversify my investment portfolio as a beginner?

A2: Beginners can diversify by investing in a mix of asset classes, such as stocks, bonds, and real estate. Using index funds and ETFs is a great way to achieve diversification with minimal effort.

Q3: Are there any low-cost investment options for beginners?

A3: Yes, low-cost options include index funds, ETFs, and robo-advisors. These investments typically have lower fees compared to actively managed funds and are ideal for beginners.

Q4: What should I consider before choosing a robo-advisor?

A4: Consider factors such as management fees, minimum investment requirements, and the range of investment options. Researching customer reviews and checking the advisor’s track record can also help.

Q5: How often should beginners review their investment portfolio?

A5: Beginners should review their investment portfolio at least once a year. However, if there are significant life changes or market conditions, a more frequent review might be necessary.