Tesla, Inc., the world’s leading electric vehicle manufacturer, has once again made headlines due to its recent financial performance. Despite its reputation for innovation and a strong market presence, Tesla has faced a significant profit shortfall in its latest financial report. This comprehensive article explores the timeline of events leading up to this point, offers expert opinions, and provides a thorough analysis of the factors influencing Tesla’s current financial state.

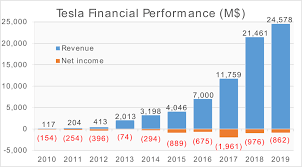

Full Timeline of Tesla’s Financial Performance

Q1 2024: Profit Shortfall

On April 25, 2024, Tesla reported its financial results for the first quarter of 2024. The results revealed a profit that fell short of Wall Street’s expectations. Analysts had projected earnings of $3.50 per share, but Tesla’s actual earnings were $2.75 per share. This underperformance led to a noticeable drop in Tesla’s stock price, reflecting investor concerns and market volatility.

April 2024: Investor Call

On April 26, 2024, during an earnings call, Elon Musk, Tesla’s CEO, addressed the disappointing financial results. Musk emphasized the company’s commitment to long-term goals, despite short-term setbacks. He acknowledged the challenges faced in meeting production targets and assured investors that the company was taking steps to address these issues.

May 2024: Market Reactions

In the first week of May 2024, Tesla’s share price experienced significant volatility. The stock briefly dipped by 8% before stabilizing. Investor sentiment was affected by the profit miss, with concerns about Tesla’s ability to sustain its growth trajectory in the face of rising competition and operational challenges.

June 2024: Strategic Initiatives

On June 15, 2024, Tesla announced a series of strategic initiatives aimed at improving its financial performance. These included advancements in battery technology, expansion into new international markets, and increased investments in autonomous driving technology. The company also revealed plans to streamline production processes and reduce operational costs.

Expert Opinions on Tesla’s Financial Shortfall

Several industry experts have provided their insights on Tesla’s recent profit shortfall:

Dr. Michael Chen, Automotive Industry Analyst at Global Insights Group, commented, “Tesla’s financial results for Q1 2024 reflect the growing pains associated with its rapid expansion. The company’s substantial investments in technology and new markets are essential for its long-term success but have led to short-term financial pressures.”

Lisa Patel, Financial Analyst at TechMarket Watch, noted, “Elon Musk’s call for patience from investors is a critical aspect of navigating these turbulent times. Tesla’s focus on innovation and market expansion requires significant upfront costs, which can impact short-term profitability. However, these investments are expected to pay off in the future.”

James Smith, Senior Investment Advisor at Capital Growth Advisors, remarked, “While Tesla’s recent financial performance may be disappointing, it is important to consider the company’s long-term strategic goals. The electric vehicle market is highly competitive, and Tesla’s continued investment in technology and global expansion is likely to yield significant returns over time.”

Emma Robinson, Senior Analyst at Energy Market Insights, added, “Tesla’s commitment to advancing battery technology and autonomous driving is crucial for maintaining its competitive edge. The company’s current financial challenges are part of a broader strategy to secure its position as a leader in the electric vehicle market.”

Factors Contributing to Tesla’s Financial Performance

1. Production Challenges

Tesla has faced significant production challenges in recent months. Supply chain disruptions and delays in obtaining key components have impacted the company’s ability to meet production targets. These issues have led to increased operational costs and contributed to the profit shortfall.

2. Increased Competition

The electric vehicle market has become increasingly competitive, with new entrants and established automakers ramping up their electric vehicle offerings. This intensified competition has put pressure on Tesla to maintain its market share while investing heavily in innovation and technology.

3. Rising Costs

Tesla’s substantial investments in new technologies, including advanced battery systems and autonomous driving features, have led to increased expenses. While these investments are aimed at driving future growth, they have impacted the company’s short-term profitability.

4. Market Expansion

Tesla’s efforts to expand into new international markets, particularly in Asia and Europe, require significant capital expenditure. These expansions are designed to capture new customer segments and drive revenue growth, but they also contribute to the company’s current financial strain.

Future Outlook and Strategic Initiatives

Despite the recent profit miss, Tesla remains focused on several key strategic initiatives:

1. Advancements in Battery Technology

Tesla is investing heavily in the development of next-generation battery technologies. These advancements are aimed at enhancing performance, reducing costs, and improving the overall efficiency of its vehicles. The company’s commitment to battery innovation is expected to strengthen its competitive position in the market.

2. Expansion into Global Markets

Tesla continues to explore opportunities for growth in international markets, with a particular emphasis on Asia and Europe. The company is establishing new production facilities and expanding its sales network to capture new customer segments and drive revenue growth.

3. Innovation in Autonomous Driving

Tesla remains at the forefront of developing autonomous driving technology. The company’s ongoing research and development efforts are focused on bringing these innovations to market, with the goal of revolutionizing the transportation industry.

4. Sustainability Initiatives

Tesla is dedicated to promoting sustainable energy solutions. The company’s investments in renewable energy projects and sustainable manufacturing practices align with its long-term vision of reducing global carbon emissions and promoting environmental sustainability.

Conclusion

Tesla’s recent profit shortfall highlights the challenges faced by the company in its pursuit of long-term growth and innovation. While the short-term financial performance may not meet expectations, Tesla’s commitment to advancing technology and expanding its market presence positions it for future success. Investors are advised to consider these factors carefully and maintain a balanced perspective on Tesla’s strategic initiatives and long-term goals.

For Regular News and Updates follow – Daily Business

Sources:

FAQs:

1. What led to Tesla’s recent profit shortfall?

Tesla’s recent profit shortfall was primarily due to production challenges, increased competition, rising costs associated with new technologies, and significant capital expenditure for market expansion.

2. How has the market reacted to Tesla’s financial results?

The market reacted with increased volatility, leading to a temporary drop in Tesla’s stock price. Investor sentiment was affected by concerns over the company’s ability to meet its financial targets.

3. What are Tesla’s strategic plans to address the financial challenges?

Tesla is focusing on advancements in battery technology, expanding into global markets, investing in autonomous driving technology, and promoting sustainability initiatives to address its financial challenges and secure future growth.

4. How does Tesla’s investment in new technologies impact its profitability?

Tesla’s investments in new technologies lead to increased expenses in the short term. However, these investments are intended to drive future growth, enhance vehicle performance, and strengthen the company’s market position.

5. What should investors consider when evaluating Tesla’s financial performance?

Investors should consider both short-term financial performance and long-term strategic goals. Tesla’s commitment to innovation, market expansion, and sustainability initiatives may provide substantial returns in the future, despite current financial challenges.