Introduction: Understanding Stocks Bonds and Mutual Funds

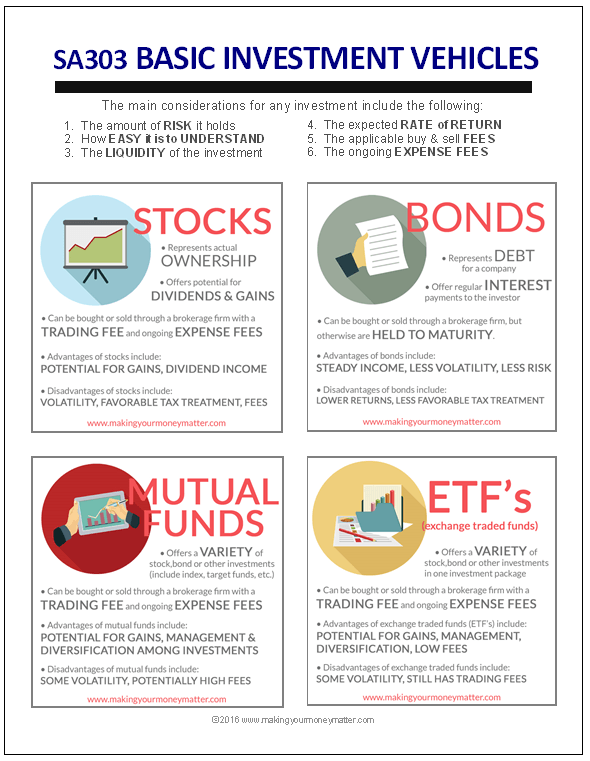

Investing can seem like a daunting task, especially with the variety of options available. Stocks, bonds, and mutual funds each offer different benefits and risks, making it essential to grasp their fundamentals to make informed decisions. This guide will walk you through the intricacies of each investment type, helping you understand their roles in a diversified portfolio and how to strategically approach your investment journey.

Stocks: Ownership, Growth Potential, and Market Dynamics

What Are Stocks?

Stocks, also known as equities, represent partial ownership in a company. When you buy stock, you are essentially purchasing a share in the company’s assets and earnings. Stocks are typically traded on stock exchanges such as the New York Stock Exchange (NYSE) or the NASDAQ.

Benefits of Investing in Stocks

- Potential for High Returns: Stocks have the potential to deliver substantial long-term growth. For instance, Amazon’s stock price increased from around $18 in 2001 to over $3,000 in 2020, demonstrating significant growth potential. (Source: Investopedia)

- Ownership and Voting Rights: Shareholders can vote on important company decisions, such as mergers or the election of board members. This gives investors a voice in the company’s future.

- Dividend Income: Many companies pay dividends, which are a portion of the company’s earnings distributed to shareholders. For example, Procter & Gamble has consistently paid dividends for over 60 years. (Source: P&G Investor Relations)

Risks Associated with Stocks

- Volatility: Stock prices can be highly volatile, influenced by factors such as market conditions, economic data, and company performance. The COVID-19 pandemic caused significant fluctuations in stock markets globally.

- Company Performance: The value of a stock is directly tied to the performance of the underlying company. Poor financial results or management decisions can lead to declines in stock value.

- Market Risk: Broader market trends can affect stock prices. For example, the global financial crisis of 2008 led to widespread declines in stock prices across various sectors.

Bonds: Stability, Steady Income, and Interest Rate Sensitivity

What Are Bonds?

Bonds are fixed-income securities where investors lend money to an organization (such as a corporation or government) in exchange for periodic interest payments and the return of the bond’s face value upon maturity. Bonds can be categorized into government bonds, corporate bonds, municipal bonds, and more.

Advantages of Investing in Bonds

- Stable Income: Bonds provide regular interest payments, known as coupons. For example, U.S. Treasury bonds are known for their reliability and steady income. (Source: U.S. Department of the Treasury)

- Lower Risk: Bonds are generally considered less risky than stocks. Government bonds, in particular, are seen as a safer investment. For instance, the U.S. Treasury bond is considered one of the safest investments due to its government backing.

- Predictable Returns: Bondholders are promised the return of their principal amount at maturity, assuming no default occurs. This predictability helps investors manage their financial planning.

Risks Involved with Bonds

- Interest Rate Risk: When interest rates rise, bond prices typically fall. This is because newer bonds issued at higher rates make existing bonds with lower rates less attractive. For example, the Federal Reserve’s rate hikes in 2023 had a noticeable impact on bond prices. (Source: Federal Reserve)

- Credit Risk: This is the risk that the bond issuer may default on its payments. Credit rating agencies like Moody’s and Standard & Poor’s provide ratings to assess this risk.

- Inflation Risk: Inflation can erode the purchasing power of the fixed interest payments received from bonds. High inflation periods, such as those experienced in the 1970s, can reduce the real value of bond returns.

Mutual Funds: Diversification, Professional Management, and Investment Strategies

What Are Mutual Funds?

Mutual funds pool money from numerous investors to invest in a diversified portfolio of assets, including stocks, bonds, and other securities. Fund managers make investment decisions on behalf of the investors, aiming to meet the fund’s objectives.

Advantages of Mutual Funds

- Diversification: Mutual funds offer diversification by spreading investments across various assets, which helps reduce individual investment risk. For instance, a mutual fund that invests in technology stocks will include shares from several tech companies, mitigating the risk of any single company’s poor performance.

- Professional Management: Experienced fund managers make investment decisions and manage the fund’s portfolio, saving investors time and providing expertise. Notable fund managers include Peter Lynch, who managed the Fidelity Magellan Fund and achieved impressive returns in the 1980s. (Source: Fidelity)

- Accessibility: Mutual funds are accessible to both novice and experienced investors, with varying minimum investment amounts and types of funds available. Funds like the Vanguard 500 Index Fund provide low-cost access to a broad market index. (Source: Vanguard)

Risks and Considerations

- Management Fees: Mutual funds charge fees for professional management, which can impact overall returns. The expense ratio, which covers management fees and other costs, should be considered when selecting a fund.

- Performance Variability: The performance of mutual funds varies depending on the fund manager’s skill and the performance of the underlying assets. Some funds may underperform relative to their benchmarks or peers.

- Market Risk: Despite diversification, mutual funds are still subject to market risk. For example, during the 2020 market downturn, many mutual funds experienced declines in value.

Comparing Stocks, Bonds, and Mutual Funds: An Analytical Approach

Risk vs. Return

Stocks generally offer higher potential returns but come with increased volatility and risk. Bonds provide stability and income but offer lower returns. Mutual funds balance these elements by offering diversification and professional management, but investors should consider fees and the risk profile of the fund.

Investment Goals and Strategies

- Long-Term Growth: Investors seeking significant capital appreciation often lean towards stocks. Long-term investing in stocks can yield substantial returns, as seen with tech giants like Apple and Microsoft.

- Income Stability: Bonds are suitable for investors seeking stable income with lower risk. For instance, retirees often invest in bonds for predictable income.

- Diversification: Mutual funds are ideal for those who want to diversify their investments without selecting individual securities. Funds such as the Schwab Total Stock Market Index Fund provide broad market exposure.

Recent Trends and Updates in Investment Options

Current Market Conditions

Recent years have seen increased market volatility due to various global events, including the COVID-19 pandemic and geopolitical tensions. This volatility has influenced stock and bond markets, making diversification through mutual funds more critical.

Innovations in Mutual Funds

The rise of index funds and exchange-traded funds (ETFs) has revolutionized mutual fund investing. Index funds, such as those offered by Vanguard and BlackRock, provide low-cost access to market indices, while ETFs offer flexibility and trading convenience. For example, the SPDR S&P 500 ETF Trust (SPY) provides exposure to the S&P 500 Index with low fees. (Source: SPDR)

Timeline of Key Developments in Investing

The Evolution of Investment Options

- Early 20th Century: The establishment of mutual funds and the creation of organized stock exchanges, such as the NYSE, laid the groundwork for modern investing.

- 1970s: The introduction of bond markets and the launch of index funds marked significant developments. John Bogle founded Vanguard in 1975, offering the first index fund for individual investors. (Source: Vanguard)

- 2000s: The rise of ETFs and the growth of online trading platforms expanded investment options. ETFs gained popularity for their low costs and liquidity.

- 2020s: The advent of robo-advisors and technology-driven investment solutions, such as Betterment and Wealthfront, has provided automated investment management and financial planning tools.

Expert Opinions on Stocks, Bonds, and Mutual Funds

Expert Insights

- Peter Lynch, Former Fidelity Magellan Fund Manager: “Investing in stocks is about finding good companies and holding them for the long term. The key is to understand the business and believe in its future potential.”

- Warren Buffett, CEO of Berkshire Hathaway: “Diversification is a protection against ignorance. It makes little sense if you know what you’re doing.”

- Jane Bryant Quinn, Financial Journalist: “Mutual funds are an excellent choice for investors who want diversification and professional management without having to pick individual stocks or bonds.”

Conclusion: Making Informed Investment Choices

Understanding stocks, bonds, and mutual funds is essential for constructing a well-rounded investment portfolio. Each type of investment offers distinct advantages and risks. By aligning your investments with your financial goals and risk tolerance, you can achieve a balanced and effective investment strategy. Staying informed about market trends and leveraging expert advice can further enhance your investment decisions.

For Regular Finance Updates Follow – Daily Business

FAQs:

1. What are the main differences between stocks and bonds?

Stocks represent ownership in a company and offer potential for high returns but come with higher risk. Bonds are fixed-income securities offering stable income with lower risk. Stocks are more volatile, while bonds provide steady income and lower volatility.

2. How do mutual funds diversify my investments?

Mutual funds pool money from many investors to invest in a diversified portfolio of assets. This diversification reduces individual investment risk by spreading investments across various sectors and asset classes.

3. What factors should I consider before investing in bonds?

Before investing in bonds, consider the bond’s interest rate, credit rating of the issuer, duration, and inflation risk. It’s also important to evaluate the bond’s yield compared to current market interest rates.

4. How can I choose the right mutual fund for my portfolio?

When selecting a mutual fund, assess your investment goals, risk tolerance, and time horizon. Look for funds with a strong track record, low fees, and a strategy that aligns with your financial objectives.

5. What are the benefits of investing in index funds compared to actively managed funds?

Index funds typically have lower fees and aim to replicate the performance of a market index. Actively managed funds seek to outperform the market but often come with higher fees and may not consistently deliver better returns.